Understanding Working Capital Loans: A Guide for Growing Businesses

In the fast-paced world of business, maintaining a healthy cash flow is as crucial as making strategic decisions for growth and sustainability. Today, we explore

J Thomas Williams, has been the entrepreneurial force behind every company he has been involved in. He heads up the ELEASE Management team. A graduate of the Peddie School Mr. Williams received his Bachelor of Arts from Boston University in 1994 in Economics.

In the fast-paced world of business, maintaining a healthy cash flow is as crucial as making strategic decisions for growth and sustainability. Today, we explore

In the ever-evolving beverage manufacturing industry, the decisions you make regarding your equipment are pivotal. This article focuses on an important but often underemphasized aspect:

Small businesses are the backbone of the economy, and their success is critical to the prosperity of local communities. However, banks are getting stingy with

We are very excited to invite our banker friends to our Tom Talk on Bankers and Brews. It should be a fun night to discuss

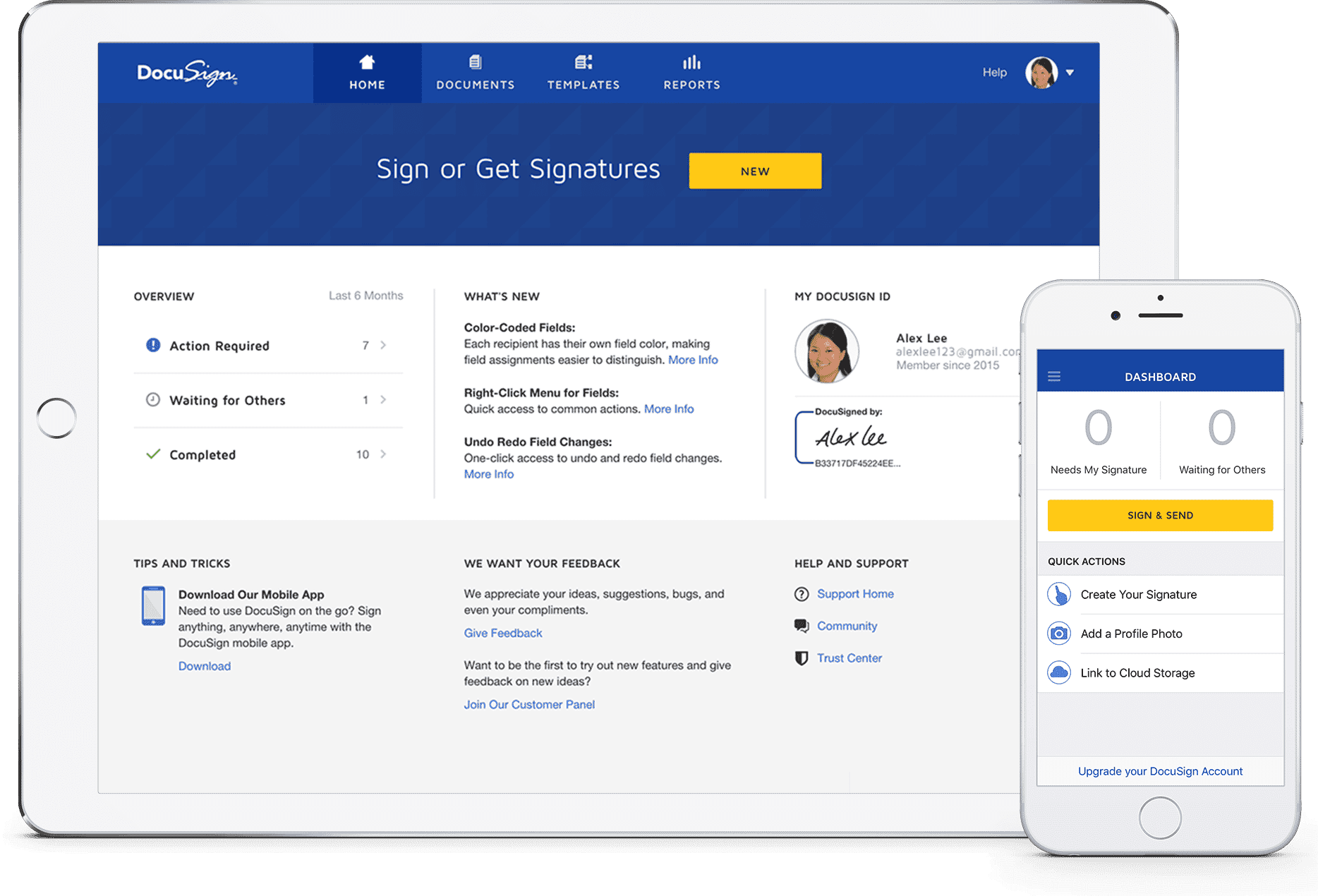

We are excited to offer digital signatures with the help of DocuSign. The “e” in ELEASE stands for education. First and foremost we provide our

The longer I am in equipment leasing and business financing I am constantly amazed some of the large strokes our business makes. From Time In

Receive all the latest news from ELEASE